The AI revolution drove frenzied funding in each non-public and public firms and captured the general public’s creativeness in 2023. Transformational shopper merchandise like ChatGPT are powered by Massive Language Fashions (LLMs) that excel at modeling sequences of tokens that characterize phrases or elements of phrases [2]. Amazingly, structural understanding emerges from studying next-token prediction, and brokers are capable of full duties resembling translation, query answering and producing human-like prose from easy person prompts.

Not surprisingly, quantitative merchants have requested: can we flip these fashions into the following value or commerce prediction [1,9,10]? That’s, moderately than modeling sequences of phrases, can we mannequin sequences of costs or trades. This seems to be an attention-grabbing line of inquiry that reveals a lot about each generative AI and monetary time collection modeling. Be warned this can get wonky.

LLMs are generally known as autoregressive learners — these utilizing earlier tokens or components in a sequence to foretell the following ingredient or token. In quantitative buying and selling, for instance in methods like statistical arbitrage in shares, most analysis is worried with figuring out autoregressive construction. Meaning discovering sequences of stories or orders or elementary adjustments that finest predict future costs.

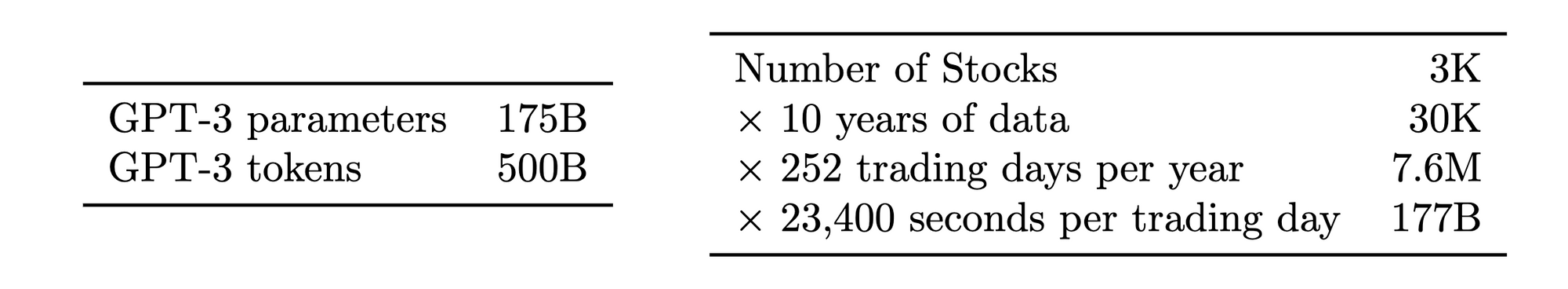

The place issues break down is within the amount and data content material of accessible information to coach the fashions. On the 2023 NeurIPS convention, Hudson River Buying and selling, a excessive frequency buying and selling agency, introduced a comparability of the variety of enter tokens used to coach GPT-3 with the quantity of trainable tokens obtainable within the inventory market information per 12 months HRT estimated that, with 3,000 tradable shares, 10 information factors per inventory per day, 252 buying and selling days per 12 months, and 23400 seconds in a buying and selling day, there are 177 billion inventory market tokens per 12 months obtainable as market information. GPT-3 was educated on 500 billion tokens, so not far off [6].

However, within the buying and selling context the tokens might be costs or returns or trades moderately than syllables or phrases; the previous is far more tough to foretell. Language has an underlying linguistic construction (e.g., grammar) [7]. It’s not laborious to think about a human predicting the following phrase in a sentence, nevertheless that very same human would discover it extraordinarily difficult to foretell the following return given a sequence of earlier trades, therefore the shortage of billionaire day merchants. The problem is that there are very sensible individuals competing away any sign out there, making it nearly environment friendly (“effectively inefficient”, within the phrases of economist Lasse Pedersen) and therefore unpredictable. No adversary actively tries to make sentences harder to foretell — if something, authors often search to make their sentences simple to grasp and therefore extra predictable.

Checked out from one other angle, there may be far more noise than sign in monetary information. People and establishments are buying and selling for causes that may not be rational or tied to any elementary change in a enterprise. The GameStop episode in 2021 is one such instance. Monetary time collection are additionally always altering with new elementary info, regulatory adjustments, and occasional giant macroeconomic shifts resembling foreign money devaluations. Language evolves at a a lot slower tempo and over longer time horizons.

However, there are causes to consider that concepts from AI will work effectively in monetary markets. One rising space of AI analysis with promising purposes to finance is multimodal studying [5], which goals to make use of totally different modalities of knowledge, for instance each photos and textual inputs to construct a unified mannequin. With OpenAI’s DALL-E 2 mannequin, a person can enter textual content and the mannequin will generate a picture. In finance, multi-modal efforts could possibly be helpful to mix info classical sources resembling technical time collection information (costs, trades, volumes, and so on.) with different information in several modes like sentiment or graphical interactions on twitter, pure language information articles and company studies, or the satellite tv for pc photos of transport exercise in a commodity centric port. Right here, leveraging multi-modal AI, one might probably incorporate all all these non-price info to foretell effectively.

One other technique known as ‘residualization’ holds prominence in each finance and AI, although it assumes totally different roles within the two domains. In finance, structural `issue’ fashions break down the contemporaneous observations of returns throughout totally different belongings right into a shared part (the market return, or extra usually returns of widespread, market-wide components) and an idiosyncratic part distinctive to every underlying asset. Market and issue returns are tough to foretell and create interdependence, so it’s usually useful to take away the widespread ingredient when making predictions on the particular person asset stage and to maximise the variety of unbiased observations within the information.

In residual community architectures resembling transformers, there’s the same concept that we need to be taught a perform h(X) of an enter X, however it is likely to be simpler to be taught the residual of h(X) to the identification map, i.e., h(X) – X. Right here, if the perform h(X) is near identification, its residual might be near zero, and therefore there might be much less to be taught and studying may be executed extra effectively. In each circumstances the objective is to take advantage of construction to refine predictions: within the finance case, the concept is to give attention to predicting improvements past what’s implied by the general market, for residual networks the main focus is on predicting improvements to the identification map.

A key ingredient for the spectacular efficiency of LLMs work is their means to discern affinities or strengths between tokens over lengthy horizons generally known as context home windows. In monetary markets, the power to focus consideration throughout lengthy horizons allows evaluation of multi-scale phenomena, with some features of market adjustments defined throughout very totally different time horizons. For instance, at one excessive, elementary info (e.g., earnings) could also be included into costs over months, technical phenomena (e.g., momentum) is likely to be realized over days, and, on the different excessive, microstructure phenomena (e.g., order ebook imbalance) may need a time horizon of seconds to minutes.

Capturing all of those phenomena includes evaluation of a number of time horizons throughout the context window. Nonetheless, in finance, prediction over a number of future time horizons can be vital. For instance, a quantitative system might search to commerce to revenue from a number of totally different anomalies which might be realized over a number of time horizons (e.g., concurrently betting on a microstructure occasion and an earnings occasion). This requires predicting not simply the following interval return of the inventory, however your complete time period construction or trajectory of anticipated returns, whereas present transformer-style predictive fashions solely look one interval sooner or later.

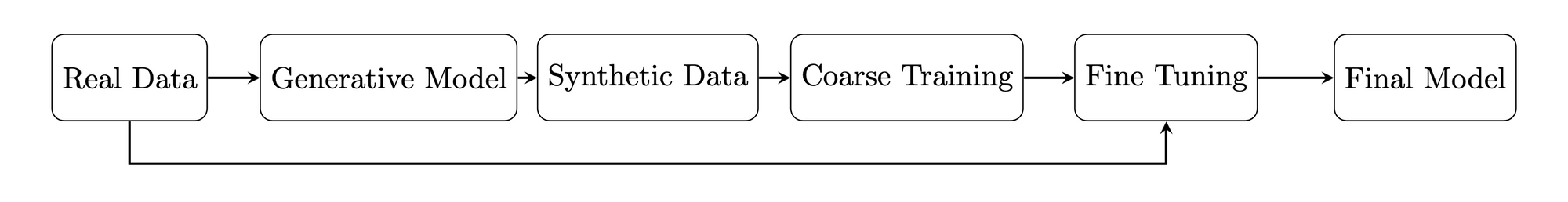

One other monetary market utility of LLMs is likely to be artificial information creation [4,8]. This might take a couple of instructions. Simulated inventory value trajectories may be generated that mimic traits noticed out there and may be extraordinarily useful provided that monetary market information is scarce relative to different sources as highlighted above within the variety of tokens obtainable. Synthetic information might open the door for meta-learning methods which have efficiently been utilized, for instance, in robotics. Within the robotic setting controllers are first educated utilizing low-cost however not essentially correct physics simulators, earlier than being higher calibrated utilizing costly actual world experiments with robots. In finance the simulators could possibly be used to coarsely prepare and optimize buying and selling methods. The mannequin would be taught excessive stage ideas like danger aversion and diversification and tactical ideas resembling buying and selling slowly to reduce the value affect of a commerce. Then valuable actual market information could possibly be employed to fine-tune the predictions and decide exactly the optimum pace to commerce.

Monetary market practitioners are sometimes focused on excessive occasions, the occasions when buying and selling methods usually tend to expertise vital positive factors or losses. Generative fashions the place it’s potential to pattern from excessive situations might discover use. Nonetheless excessive occasions by definition happen hardly ever and therefore figuring out the appropriate parameters and sampling information from the corresponding distribution is fraught.

Regardless of the skepticism that LLMs will discover use in quantitative buying and selling, they may increase elementary evaluation. As AI fashions enhance, it’s simple to think about them serving to analysts refine an funding thesis, uncover inconsistencies in administration commentary or discover latent relationships between tangential industries and companies [3]. Primarily these fashions might present a Charlie Munger for each investor.

The shocking factor in regards to the present generative AI revolution is that it’s taken nearly everybody – educational researchers, innovative expertise corporations and long-time observers – abruptly. The concept that constructing greater and larger fashions would result in emergent capabilities like we see right now was completely surprising and nonetheless not absolutely understood.

The success of those AI fashions has supercharged the move of human and monetary capital into AI, which ought to in flip result in even higher and extra succesful fashions. So whereas the case for GPT-4 like fashions taking on quantitative buying and selling is at the moment unlikely, we advocate holding an open thoughts. Anticipating the surprising has been a worthwhile theme within the AI enterprise.

References

- “Making use of Deep Neural Networks to Monetary Time Sequence Forecasting” Allison Koenecke. 2022

- “Attention is all you need.” A Vaswani, N Shazeer, N Parmar, J Uszkoreit, L Jones… Advances in Neural Data Processing Programs, 2017

- “Can ChatGPT Forecast Inventory Worth Actions? Return Predictability and Massive Language Fashions” . Lopez-Lira, Alejandro and Tang, Yuehua, (April 6, 2023) Out there at SSRN

- “Generating Synthetic Data in Finance: Opportunities, Challenges and Pitfalls.” SA Assefa, D Dervovic, M Mahfouz, RE Tillman… – Proceedings of the First ACM Worldwide Convention …, 2020

- “GPT-4V(ision) System Card.” OpenAI. September 2023

- “Language models are few-shot learners.” T Brown, B Mann, N Ryder, M Subbiah, JD Kaplan… – Advances in Neural Data Processing Programs, 2020

- “Sequence to Sequence Studying with Neural Networks.” I.Sutskever,O.Vinyals,and Q.V.Le in Advances in Neural Data Processing Programs, 2014, pp. 3104–3112.

- “Artificial Information Era for Economists”. A Koenecke, H Varian – arXiv preprint arXiv:2011.01374, 2020

- C. C. Moallemi, M. Wang. A reinforcement studying strategy to optimum execution. Quantitative Finance, 22(6):1051–1069, March 2022.

- C. Maglaras, C. C. Moallemi, M. Wang. A deep studying strategy to estimating fill chances in a restrict order ebook. Quantitative Finance, 22(11):1989–2003, October 2022.

Quotation

For attribution in educational contexts or books, please cite this work as

Richard Dewey and Ciamac Moallemi, "Monetary Market Purposes of LLMs," The Gradient, 2024@article{dewey2024financial,

writer = {Richard Dewey and Ciamac Moallemi},

title = {Monetary Market Purposes of LLMs},

journal = {The Gradient},

12 months = {2024},

howpublished = {url{https://thegradient.pub/financial-market-applications-of-llms},

}Source link

#Monetary #Market #Purposes #LLMs

Unlock the potential of cutting-edge AI options with our complete choices. As a number one supplier within the AI panorama, we harness the ability of synthetic intelligence to revolutionize industries. From machine studying and information analytics to pure language processing and laptop imaginative and prescient, our AI options are designed to reinforce effectivity and drive innovation. Discover the limitless prospects of AI-driven insights and automation that propel your enterprise ahead. With a dedication to staying on the forefront of the quickly evolving AI market, we ship tailor-made options that meet your particular wants. Be part of us on the forefront of technological development, and let AI redefine the way in which you use and achieve a aggressive panorama. Embrace the long run with AI excellence, the place prospects are limitless, and competitors is surpassed.