Royal Bank of Canada (RBC), headquartered in Toronto, Ontario, is Canada’s largest bank and one of the world’s largest by market capitalization. Operating across 29 countries and employing upwards of 98,000 employees as of 2024, the company reported an annual total revenue of $57 billion and a record net income of $16.2 billion, driven in part by the acquisition of HSBC Bank Canada and the strong performance of acquisitions in the UK and EU.

RBC’s commitment to internal AI deployment is evidenced by RBC Borealis, a research institute within RBC that serves as the bank’s default AI center of excellence.

The institute describes itself as performing fundamental and applied research in machine learning with the goal of advancing the state-of-the-art in AI for financial services and beyond. Launched in 2016 and now boasting 950+ employees, the institute’s growth and extensive research output confirm the level to which RBC regards AI within its business strategy.

Further evidence of RBC’s commitment to AI is clear in its significant capital allocation — a 2025 “Investor Day” presentation notes the bank is currently investing over $5 billion in technology to accelerate innovation. This investment is tied to a bold, measurable financial outcome: RBC’s strategic AI ambition targets generating a substantial $700 million to $1 billion in enterprise value from AI by 2027.

The bank’s explicit focus demonstrates that AI is highly integrated into RBC’s corporate framework, where fundamental research must yield a clear, anticipated pathway to scale, monetization, and reduced risk.

This article examines two mature, internally deployed applications that illustrate AI’s central role in Royal Bank of Canada’s core operations:

- Leveraging machine learning to adapt to evolving risk: Implementing federated machine learning methods for better pattern matching and the elimination of sensitive data exchange.

- Applying deep learning for optimised pricing strategies: Utilising deep reinforcement learning to provide greater control to traders while minimising slippage against industry benchmarks.

Leveraging AI and ML to Adapt to Evolving Risk

The financial sector faces enormous challenges as AI becomes more widespread. A recent study by the Ontario Securities Commission (OSC) found that AI-enhanced scams pose significantly greater risk, with controlled tests showing participants invested 22% more in AI-enhanced scams than in conventional scams.

For context, data from the Canadian Anti-Fraud Centre (CAFC) reveals that Canadians lost $638 million to fraud in 2024 alone. That number is expected to grow as AI technology becomes more widely adopted, leading to more sophisticated approaches. A blog post published by RBC warns that social engineering attacks and ever-more complex AI-powered scams are becoming even more believable and successful.

To address these challenges, RBC launched a fraud modernization initiative that is transitioning its defense systems from static rules to adaptive, real-time risk scoring engines powered by advanced AI and Machine Learning (ML).

According to a company press release, the foundational infrastructure was custom-built, enabling complex event processing and embedding behavior analytics and fraud prediction capabilities. The system leverages the bank’s massive data stream, analyzing roughly 11 trillion security events in 2024 alone, as reported in the Investor Day presentation.

A notable example of RBC’s approach to tackling fraud is a joint experiment with Vector Institute to address a new and growing threat to financial services: mule account fraud.

Mule account fraud occurs when criminals scam victims into allowing them to use their bank accounts, or when criminals open accounts using stolen identification documents. Because they often operate across multiple institutions to obfuscate their activities, the technique has proven particularly difficult to counter.

Fraud detection relies heavily on analyzing sensitive information, such as transaction data, device activity, and user behavior. The addition of AI increases the risk of violating privacy laws, as AI systems can collect excessive data, handle it insecurely, or even misuse it.

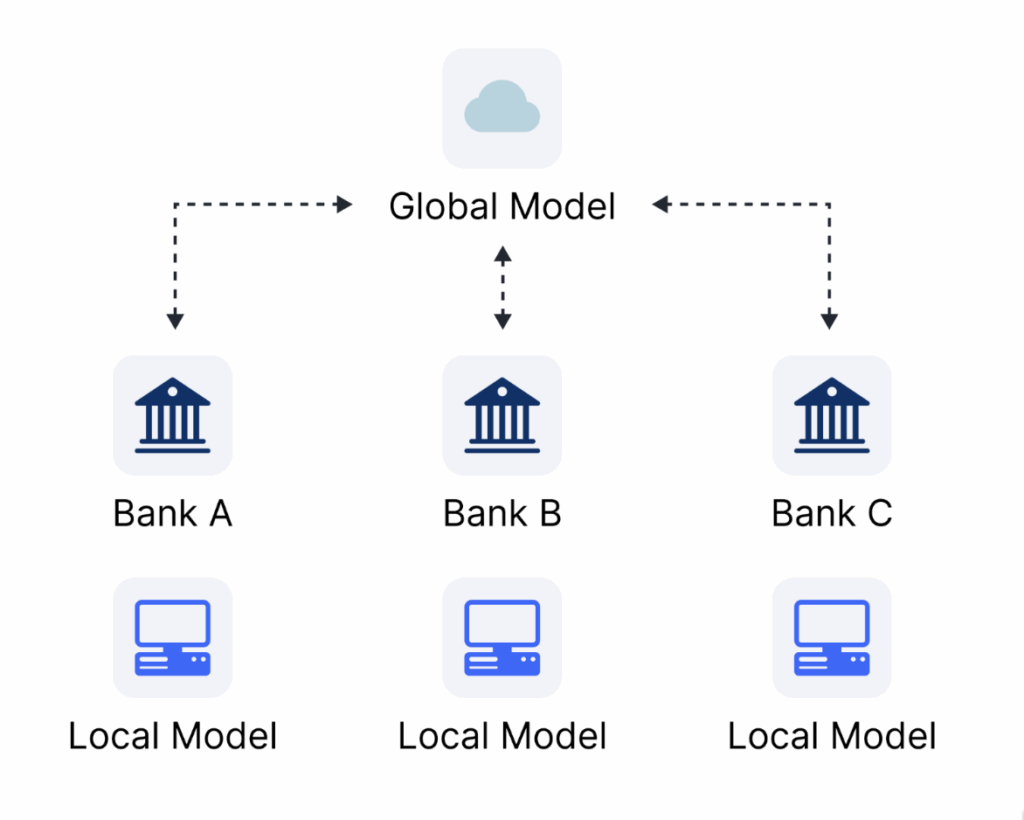

As reported by Borealis AI, the joint approach to address mule account fraud leveraged advanced machine learning and federated learning. The federated technique allows multiple institutions to train models collaboratively without exchanging sensitive customer data, while still benefiting from patterns observed across multiple banks.

According to the report, the participating banks each train a local model on their own data, with only the learned model parameters being aggregated into a global model shared by all. The result is the detection of fraud patterns that may be invisible to any single institution.

(Source: RBC Borealis)

The results showed “notable improvements in performance metrics for all clients” and that shared learning across clients helped generalize better to fraud patterns.

Applying Deep Learning for Optimised Pricing Strategies

According to a World Economic Forum white paper, financial services firms spent $35 billion on AI in 2023, with projected investments across banking, insurance, capital markets, and payments businesses expected to reach $97 billion by 2027.

An Ernst & Young analysis shows the reason for such robust investment: AI models consistently outperform most traditional models, yielding greater economic gains.

The ability of models to process both structured and unstructured datasets and analyze vast volumes from many diverse sources provides evidence of gains too numerous for the sector to ignore.

The financial services sector is also seeing tech companies entering their territory — the partnership between Apple and Goldman Sachs being one such example.

EY reporting elsewhere notes that, in response to the industry’s technological upheaval, banks are strategically reallocating their IT budgets toward innovations that can effectively counter threats from tech giants and emerging business models.

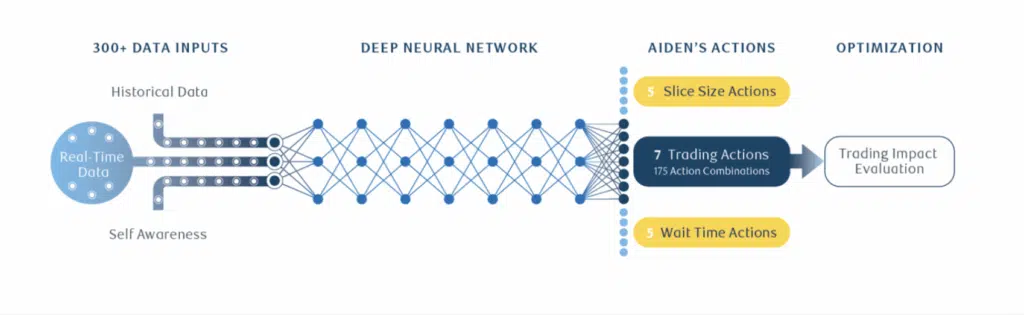

With the industry primed for change, RBC and its RBC Borealis AI research institute launched Aiden in 2020, an AI-powered electronic trading platform that aims to provide better insights and improved execution for the business and its clients worldwide.

According to the company’s landing page for Aiden, the platform’s volume-weighted average price (VWAP) strategy seeks to minimise slippage relative to the market VWAP benchmark, even during periods of volatility.

Using deep reinforcement learning to learn from past actions and execute trading decisions based on live market data, Aiden VWAP dynamically adapts to new information in real time. Rather than following a set of rules, the Aiden algorithm learns continuously through trial and error and a robust reward system, ultimately finding greater success with fewer inputs.

Building on the success of the Aiden VWAP, RBC Capital Markets explains that Aiden Arrival seeks to address the arrival price challenge — the persistent challenge of accurately calculating the arrival price of a financial trade — through a more holistic benchmark evaluation. Aidan Arrival also shows further optimisation, providing an expanded trading action set that provides greater flexibility and control for traders.

Source link

#Artificial #Intelligence #Royal #Bank #Canada