- How can banks scale AML compliance in an increasingly complex and high-risk environment without compromising the commercial client experience? How do banks move beyond throwing people at the problem?

- What role does data play in transforming onboarding from a compliance burden into a competitive advantage? How can banks better collect, orchestrate, and reuse data to streamline onboarding and reduce duplication?

- How can banks move from reactive compliance to proactive, intelligent onboarding using automation and AI? What use cases exist today? What does good look like? How can banks lay the groundwork to scale advanced technologies responsibly?

- What are the practical steps to optimise onboarding journeys so that they are fast, safe, and scalable, across multiple jurisdictions? How can banks harmonise their approach while improving customer outcomes?

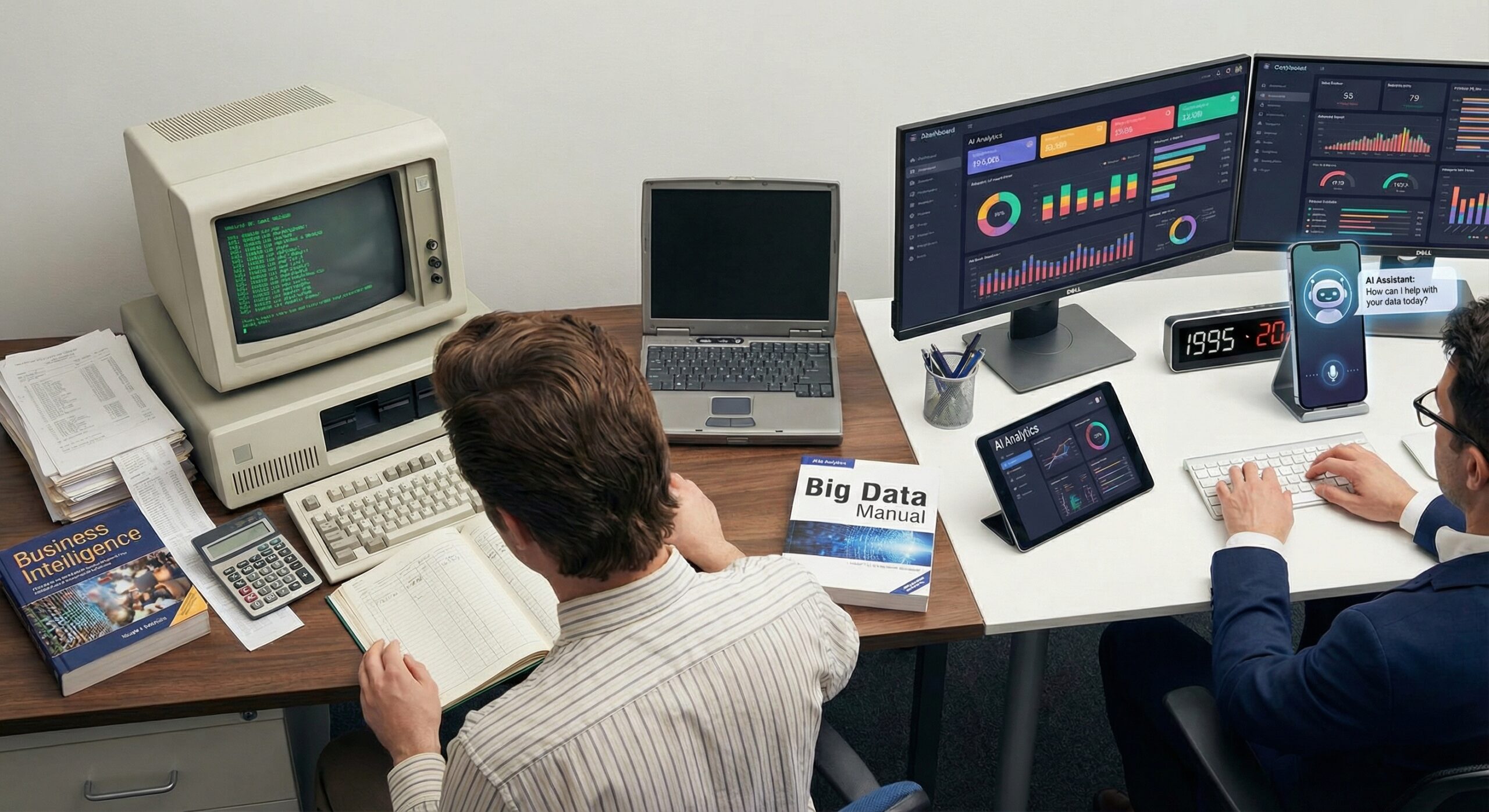

Regulation is intensifying, with daily sanctions updates and mounting fines, yet manual workarounds still dominate. Compliance teams remain overwhelmed by outdated processes and legacy systems, often relying on human intervention to resolve complex onboarding scenarios. This approach may provide short-term cover, but it’s unsustainable, costly, error-prone, and damaging to the client experience. As financial crime risk rises and regulators increase scrutiny, banks are at a tipping point: they must optimise onboarding not as a series of disconnected checks, but as a strategic function critical to both compliance and customer trust.

From initial KYC to downstream processes like loan origination and lifecycle management, effective onboarding hinges on the ability to collect, connect, and reuse data intelligently. Too often, data is siloed or incomplete, leading to duplication of effort, delays, and an inconsistent experience for commercial clients. A strong data foundation can change that, enabling banks to automate routine tasks, identify risks earlier, and deliver a seamless journey from day one. Crucially, good data strategy isn’t just a back-office concern, it’s the engine that powers scale, speed, and regulatory resilience.

Further, optimising onboarding is an essential first step, but it is only the beginning of a much broader journey. With the tools and data available today, many banks are looking for end-to-end client lifecycle management (CLM) solutions that cover everything from onboarding to relationship management, periodic reviews, compliance monitoring, and even offboarding. Having this longer term view can support banks build robust strategies, especially against the backdrop of upcoming EU AML directives and global regulatory fragmentation.

Banks are under pressure to standardise processes while maintaining the agility to meet local requirements. This complexity makes it harder to maintain compliance, let alone optimise for speed or service. Institutions that succeed will be those that invest in flexible infrastructure, harness AI where it adds value, and improve onboarding journeys in a way that balances safety with simplicity. The goal isn’t just to survive another round of regulation, it’s to emerge more competitive, efficient, and trusted by commercial clients.

Register for this Finextra webinar, hosted in association with nCino, to join our panel of industry experts who will discuss how banks can scale AML compliance in an increasingly complex and high-risk environment without compromising the commercial client experience.

Source link

#Optimising #Onboarding #Age #AML #Rising #Risk