With concerns about declining sales and discoverability, UploadVR spoke with nearly two dozen VR studios to discuss the current state of shipping VR games on Quest.

It’s become increasingly apparent since last year that things are not what they once were, despite Meta’s lead in VR and AR seeming unassailable. Meta’s Reality Labs division is reporting record revenues, and Quest 3S seems to be selling well. Yet for many developers making VR games, the mood has soured.

Some developers are buoyed by revenue through subscription programs like the Quest+ gaming catalog, with every new Quest 3S headset including three months of Quest+. However, many others are now struggling to find sales and to support their teams long-term. UploadVR spoke to developers with concerns about declining sales to learn about the current state of VR game development on Meta’s store.

Here’s our initial report.

For Those Just Joining Us

Quest 3S seemingly had a successful launch late last year, with pack-in title Batman: Arkham Shadow reaching over one million players. Reality Labs as a whole earned its highest ever quarterly revenue last quarter.

But before his departure, Meta’s original technical guide through VR John Carmack warned that “setting out to build the metaverse is not the best way to wind up with the Metaverse.”

Carmack noted:

“Mark Zuckerberg has decided that now is the time to build the metaverse. So enormous wheels are turning and resources are flowing and the efforts definitely going to be made. So the big challenge now is to try to take all of this energy and make sure it goes to something positive and we’re able to build something that has real near-term user value because my worry is that we could spend years and thousands of people possibly and wind up with things that didn’t contribute all that much to the ways that people are actually using the devices and hardware today.

A memo was recently leaked from Meta’s CTO Andrew Bosworth noting “Horizon Worlds on mobile absolutely has to break out for our long term plans to have a chance.”

2025, it is said then, will determine whether Meta’s hardware and metaverse division is “the work of visionaries or a legendary misadventure”.

The wider video games industry continues seeing layoffs despite the industry’s market value reportedly reaching around $184.3 billion. Factors cited by some include overinvestment following the COVID-19 pandemic and increasing development costs. Hearing about newly affected studios ending projects or reducing team sizes feels like a weekly occurrence and, for some, Quest is no longer delivering some studios the same returns they’ve once seen.

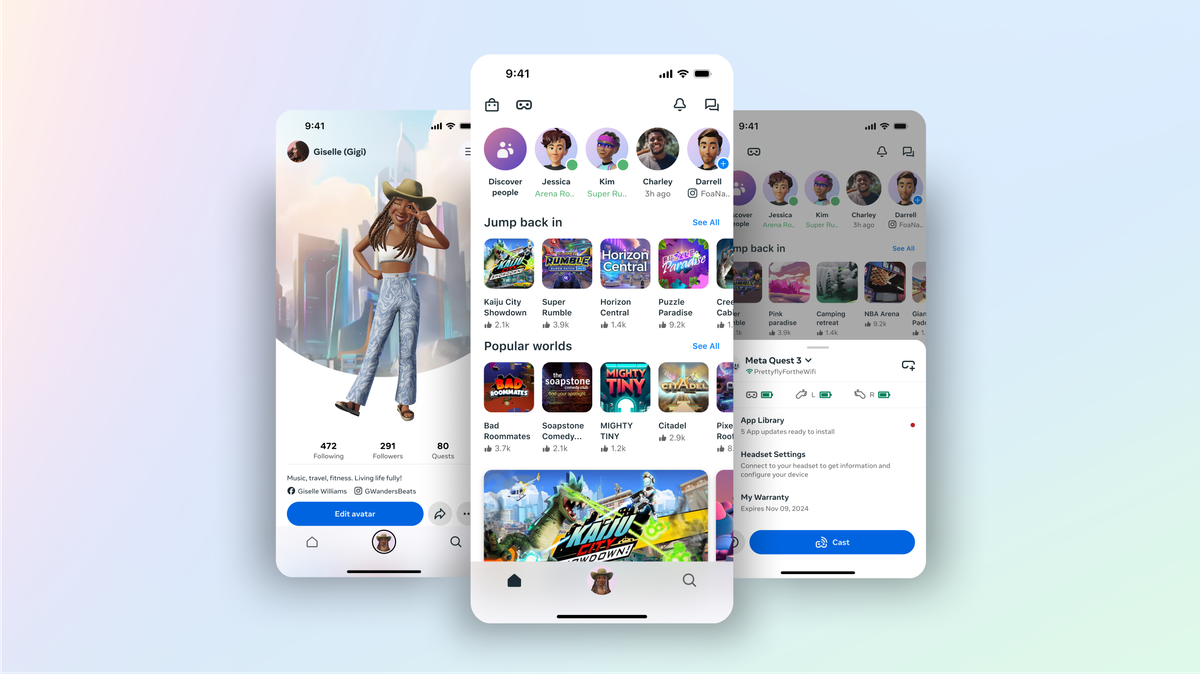

The pace of complaints from developers seemed to speed up after the Meta Horizon App’s redesign back in July, with many citing the transition in their interviews as a sore spot. For some, the store is still profitable, with Eye of the Temple only recouping its development costs after being ported to Meta’s headset, even as Gorilla Tag cleared more than $100 million.

But for developers seeing declining sales, what exactly is going wrong?

Quest Phone App Rebranded To Meta Horizon After Redesign

The Meta Quest smartphone app is being rebranded to Meta Horizon next week. It comes after the app recently got a new design and performance improvements.

Many point to issues concerning discoverability, curation, Meta’s increased focus on Horizon Worlds and the decision to merge App Lab with the main store as a tipping point for revenue decline.

Most studios requested anonymity in their talks with UploadVR to protect their relationships with Meta, though Andrew Eiche at Owlchemy Labs, Kevin Walker at Middle Man Games, and Alex Nasanov at iTales VR agreed to go on the record. As part of our discussion, Eiche made clear his comments are solely on his and Owlchemy’s behalf and do not represent Google, which owns the veteran studio.

Horizon Worlds

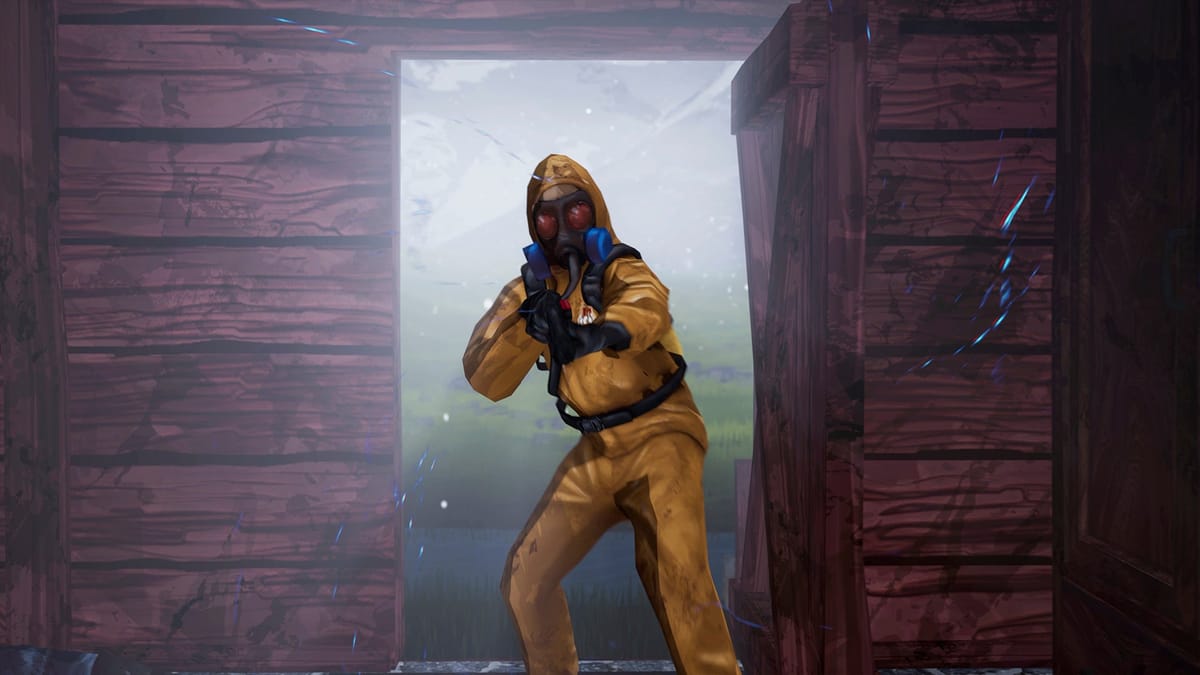

Most developers feel Horizon Worlds is getting increased attention at the expense of store apps, mentioning it when asked how they view Meta’s general direction. Several suggested this approach indicates Meta is pushing a mobile approach aimed at younger audiences, trying to entice young players who have no wallets by prioritizing free-to-play content. They perceive Meta as promoting Horizon Worlds as the default experience for VR users rather than paid apps on the storefront.

“This is not the direction I would have chosen,” Andrew Eiche said over a video call with UploadVR. “I think they made a video game console and they want a general computing device.”

Notably, Dimensional Double Shift from Owlchemy released as a free multiplayer app on Meta’s storefront after a string of paid releases. Technically, this content type isn’t supported by Horizon Worlds, which still requires physical input of some kind.

Multiple developers sent us pages of screenshots of search results featuring what look like Horizon Worlds clones of premium games competing with paid work, and sometimes winning in search rankings.

“This is bad for us devs. It’s bad for consumers,” states Kevin Walker. “And when they show free [Gorilla Tag] clones above paid apps, I don’t see how it’s even good for Meta.”

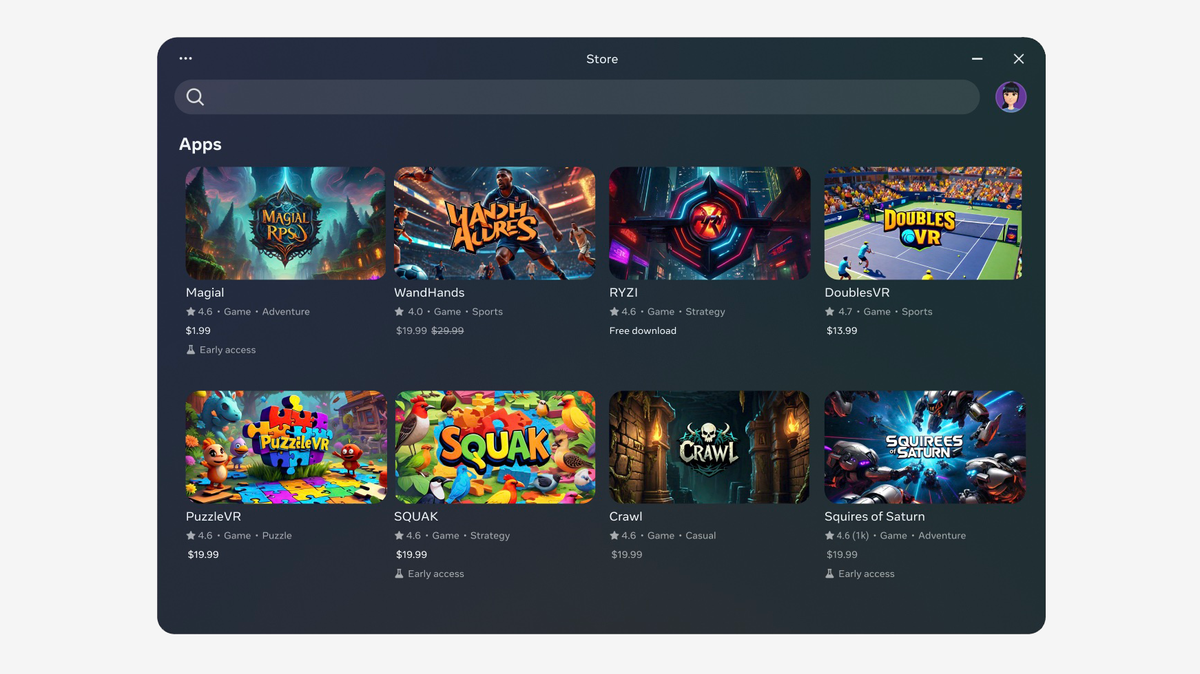

Quest’s App Lab Is No More As Meta Horizon Store Launches

App Lab has now been merged into the Meta Horizon Store, the new name for the more open Quest Store.

Eiche and others praised the Quest Store for what it’s delivered in the past, with multiple platinum releases clearing one million units. Others understand Meta’s priorities, but the prevailing sentiment in our talks with developers is concern and frustration.

Here’s a series of selected direct quotes from the developers with paid releases on the Quest Store who wished to remain anonymous:

- “Meta will prioritize whatever leads to more users, market share and profit. At the moment, I don’t think they have doubled down on what the best path is, so they are trying everything.”

- “Meta is not interested in being a gaming platform anymore — they just want to be a metaverse, and they just happen to have a legacy store.”

- “You end up with the kind of worst of both worlds for smaller developers — loads of games, and no chance of yours getting shown on any shelves.”

- “The heavy promotion of Horizon Worlds feels reminiscent of monopolistic practices. You wouldn’t see Apple or Epic prioritizing their own apps this aggressively within their stores.”

- “It feels a bit like Meta has seen the Store data and is keeping it as a legacy option rather than the future of the platform.”

- “If Meta wants developers to thrive and create sustainable businesses, they must realign the Quest Store’s focus.”

Meta CTO: 2025 Will Determine Whether AR/VR Bet Is Visionary Or “A Legendary Misadventure”

In a leaked memo, Meta’s CTO told staff that 2025 will determine whether its hardware & metaverse division is “the work of visionaries or a legendary misadventure”.

Horizon Worlds and its free destinations competing for search, promotion, and time in VR is one aspect of paid store developer frustrations, but Meta also stopped curating content on the storefront more generally in 2024.

App Lab Removal, Curation Cessation & Search

Many studios criticized the lasting impact of Meta getting rid of App Lab last year, which arrived in two stages.

Scott Albright, CEO for Combat Waffle Studios, previously told UploadVR last year that he wasn’t a fan of App Lab being discontinued, and that sentiment’s only grown.

Ghosts Of Tabor Devs Plan Early Access For GRIM & Silent North

As GRIM and Silent North head for early access, the Ghosts of Tabor studio’s CEO isn’t a fan of Meta phasing out App Lab.

Many developers see the move to make the store “open” as being a good one overall because it lowers barriers to entry. One studio called it “an inevitable step” for any platform looking to grow, and a positive change. That same developer, however, suggested Meta “wasn’t ready to manage the vast amount of very unpolished content and the lack of a warning time.”

“I believe that this has also shifted the type of content that gets visibility on the store now and, as a consequence, opened up its doors for developers with new approaches to VR game development and also new ways of monetization. This has caused legacy devs and publishers having to adapt to new times, which takes a while,” said another developer.

SideQuest Isn’t Accepting Gorilla Tag Clones Anymore

VR content sideloading platform, SideQuest, will no longer be accepting games that imitate multiplayer hit, Gorilla Tag. The platform announced as much on Twitter today. “We appreciate the time and effort you have put into making a game similar to gorilla tag, it’s very popular,” the message reads. “At

Here’s another set of direct quotations from developers on their issues with the changes around curation:

- “As someone who has been on both sides, App Lab and Store, I think it is a good thing that App Lab was merged and got more visibility. But to me, it seems it was done without any thought out plan behind it.”

- “Our reach, which is how many people see the game, has dropped by 60% since the Horizon push & App Lab merge.”

- “Funding games/film/art/tech journalists to search the store and write about hidden gems would be a great idea.”

- “I do expect that if someone searches for Puzzle games, they can actually see ALL [of the] puzzle games,” said Kevin Walker, who previously released VR puzzler Twistex in 2023.

- “Through some combination of poor discoverability, poor store page to sale conversion and general VR market conditions, our sales numbers so far are lower than our lowest expectations and predictions.”

- “When Quest 3s launched, you couldn’t even tell from the sales data that a new and affordable headset had launched… I think that this is not necessarily due to Quest 3s selling so much less, but due to those players not reaching the store and buying games.”

Some studios consider the removal process was rushed, though others argue that App Lab wasn’t really merged in. One team says Meta “removed the main store” and put everyone on App Lab. Eiche says they changed the store to be like Google Play or Apple’s App Store, though he concedes there are arguments both ways with an open platform.

Attack Of The Gorilla Tag Clones And Discoverability

In recent times, the Horizon Store’s home page seems to have improved when searching on desktop or inside the headset. Though the mobile app still prioritizes mobile Horizon Worlds content when you load it up, with no means to adjust this, the desktop homepage begins by highlighting the most popular apps and top-selling that week.

But it is not long before you reach the ‘Browse All‘ category, where listed entries often have some variation on the words “Gorilla,” “Tag” or “monkey.” These often outrank Gorilla Tag itself due to inflated ratings from a small number of users. Many of those we spoke with view the Quest Store’s current discoverability poorly, and worse than Steam. One developer likened it to entering a department store filled with cheap clothes during the holidays.

One studio called being discovered their biggest issue next to funding, while another said navigating the store has become “unnecessarily difficult.” Another expressed frustrations that promised support over marketing and reaching the main store never materialized.

Adding mixed reality labels on the developer dashboard side are still curated by Meta, yet other genres are not. Some genres in the developer settings aren’t reflected as filters on the actual store, which is causing some frustrations, while others don’t show the full selection of games in a specific genre.

Decreasing Sales

Just how badly have developers been affected saleswise? The exact percentage naturally varies depending on who you ask, but some of those who aren’t supported by a platform subscription program suggest revenue drop-offs for their games between 50 – 80% for 2024 compared to 2023.

Sales impact was much more visible in the second half of 2024 for many. One studio explains that developers usually expect a big spike in sales when a new headset launches, even more so when you factor in Christmas sales. One studio says that didn’t happen with Quest 3S, despite retailers like Amazon reporting high sales.

Quest 3S Was The Top Selling Console On Amazon In 2024

Meta Quest 3S was the top selling games console on Amazon US in 2024, despite only releasing in October.

“When Quest 3s launched, you couldn’t even tell from the sales data that a new and affordable headset had launched… I think that this is not necessarily due to Quest 3s selling so much less, but due to those players not reaching the store and buying games,” states one studio.

One developer believes Meta should implement more mechanisms like Steam Daily Deals to provide indie titles enough sales to cover months of costs. Another points toward both declining sales across the entire gaming industry and a shift toward younger audiences.

“This demographic typically spends less compared to adult gamers, raising the question: where have the adult VR gamers gone?”

Of course, games aren’t guaranteed to be a success at launch, no matter the platform. Even with strong reviews and great marketing, games sometimes just fail to land with an audience for a myriad of reasons. Critical success doesn’t equal commercial success and, for a niche market, the end of 2024 delivered a relentless stream of new releases.

From October to December, the following games saw release on various platforms:

- Batman: Arkham Shadow

- Skydance’s Behemoth

- Alien: Rogue Incursion

- Metro Awakening

- Arizona Sunshine Remake

- Human Fall Flat VR

- Maestro

- Just Dance VR

- Vendetta Forever

- The House of Da Vinci VR

- Triangle Strategy

- Action Hero

- Home Sports

- Attack on Titan VR: Unbreakable

- DIG VR

And that’s just some of the list. I’ve never seen such a hefty lineup of big VR games released in such a short timeframe. Some of that could be attributed to the Quest 3S launch, and while most developers we spoke with didn’t have the most positive results, it’s not impossible to break through or at least get close. In a separate interview outside this report, Flat2VR Studios advised Trombone Champ: Unflattened was close to hitting sales expectations despite the fierce competition.

Flat2VR Studios Reflects On Its First Year, Choosing What To Adapt & Future Plans

Following Trombone Champ: Unflattened, what’s next for Flat2VR Studios? In our recent interview, the studio reflects on its first year, how they choose games, and future plans.

So there’s a mix of heavy competition, poor discoverability, search issues, increasing promotion of Horizon Worlds, and a userbase that perhaps isn’t big enough to support such a wide range of games. This hasn’t gone well for many, set in context of wider economic issues like the increasing cost of living leaving people with less disposable income.

“There’s a bigger, more insidious core problem that’s happening. The amount of money that consumers are willing to spend on apps that you pay for is shrinking,” Eiche said.

Owlchemy doesn’t believe declining sales are necessarily due to games reaching the tail-end of their life cycle. He suggested Vacation Simulator and Cosmonious High — which recently received price cuts — have discoverability issues, while Job Simulator still regularly charts in the top 10. Even in such a high spot though, Owlchemy’s debut hit is making less money than it once did.

“I would love to be like, ‘Hey, Job Simulator had a great run.’ That’s great. But then when I see it in the top 10 or in the top four but the amount it’s making is an order of magnitude less, like half as much as it did before,” Eiche said. “That to me says that the overall amount of money being put into the store is shrinking.”

Dimensional Double Shift Is A Co-Op Party Game From The Job Simulator Studio

Dimensional Double Shift, a co-op party game from the Job Simulator studio that only uses hand tracking, is out now on Quest.

This doesn’t necessarily mean there are fewer Quest users, but it suggests more are opting for free-to-play experiences over premium content.

Quest+ Subscriptions

Meta Quest+ is a subscription program providing access to two pre-selected monthly games and a rotating selection of VR titles via its Games Catalog. It’s drawn the inevitable comparisons with Xbox Game Pass, and Sony’s own PlayStation Plus service. Meta includes a 3-month subscription with every new Quest 3S headset, meaning anyone who received a headset over Christmas still has this.

For some developers, revenue from the programs can close the gap with revenue lost from store sales.

Releasing games on Quest+ immediately feels like a “double-edged sword” to some though, with games failing to reach sustainability across both store and subscription channels. Another developer expressed skepticism about subscriptions wholesale, calling the model a “catastrophic disaster” for the music industry. Others just see it as a new name for curation at Meta.

“It is a great option and helps users discover great content BUT it cannot be [the] only method for doing so,” one developer said. “Which currently it is.”

Some believe Quest+ gives users fewer reasons to go looking for games to purchase, stating this complements Meta’s push with moving users to free apps. Despite this, most developers agreed the subscription service is great for consumers.

“Quest+ is a form of curation because anything where you pick out apps is a form of curation. I think that’s another line of business,” says Andrew Eiche, who calls Quest+ a good way of recommending titles. “I don’t see Meta pushing that as the answer.”

Better Sales On Steam or PS VR2?

With declining Quest sales being a common issue across these studios, has this lead to an uplift in sales across other headsets for multiplatform developers?

Based on the developers we spoke with, generally no, but with a few notable exceptions:

- “Steam 22% vs. Meta 78% after 6 weeks.”

- “[Steam] gives me a much lower reach but it’s a much bigger pond, so I would expect that,” advised Kevin Walker.

- “Generally we’ve had a 90% Quest — 10% Steam split.”

- “It depends on the type of game but in our case, Meta is without a doubt the best-selling platform. Steam and PlayStation go next for us, but we see them as secondary streams of revenue.”

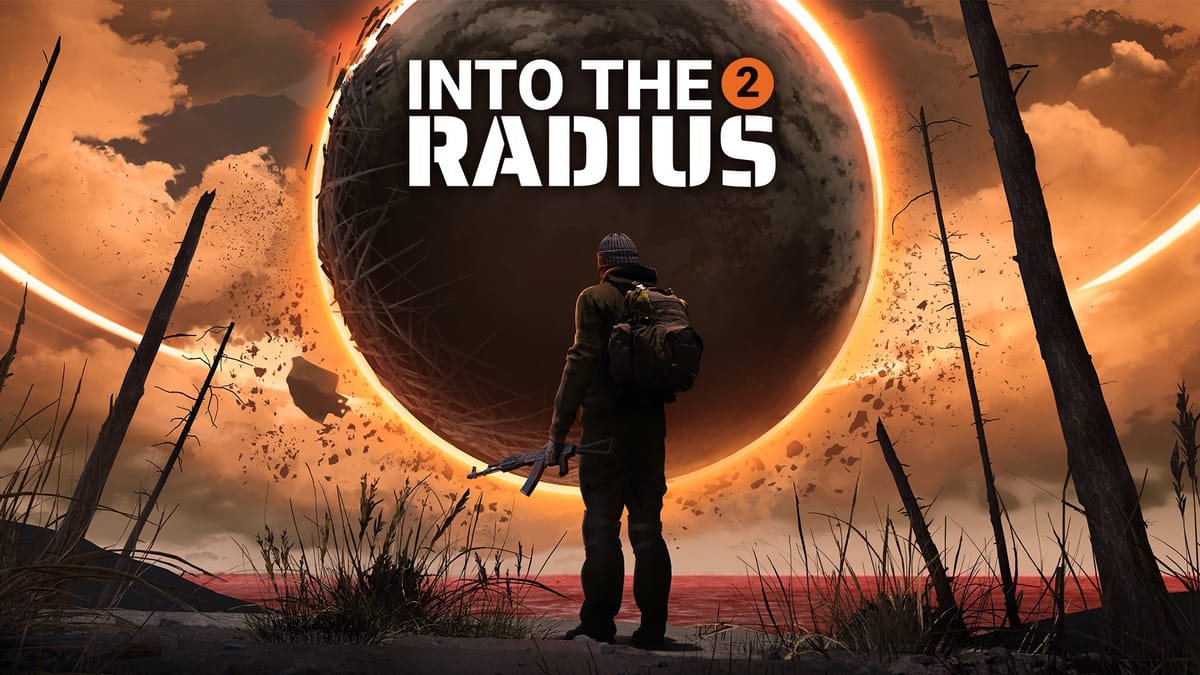

Still, the exceptions are interesting to note. For example, Into The Radius hit 800k sales and its sequel reached nearly $3m revenue in early access so far.

How Into The Radius 2 Hit Nearly $3M Revenue So Far On Steam Early Access

Into The Radius 2 has earned nearly $3 million revenue so far, and we interviewed CM Games to discuss its early access launch.

One CEO reported 90% of sales came from Steam compared to Quest, attributing this to being featured on the Steam front page after participating in themed sales and festivals. Another developer saw 2024 on Steam outperform their sales in 2023 and 2022. Even with Quest being their main source of revenue, one studio advised the difference with Steam is “shrinking more and more.”

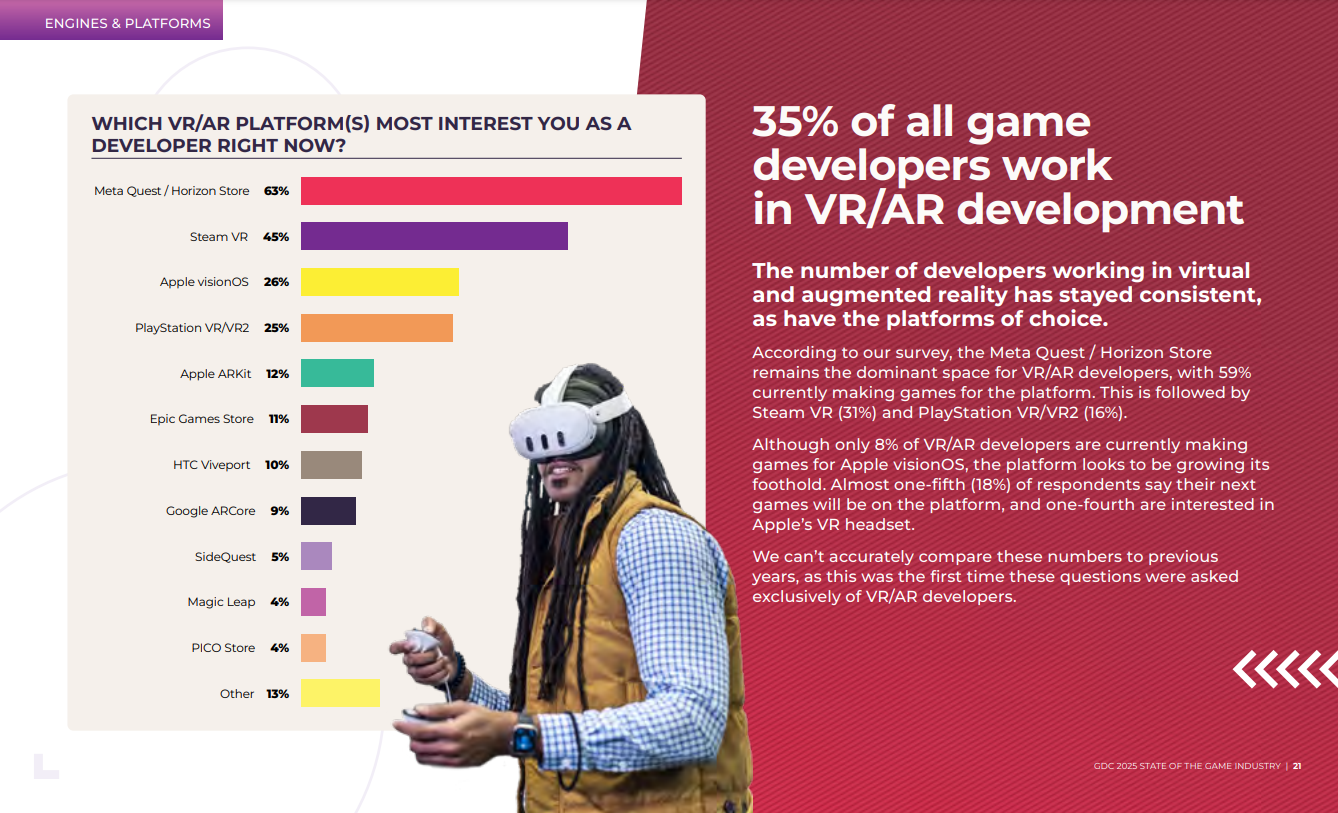

One studio told UploadVR lower than expected sales on Quest means they’ll be focusing on multiplatform launches in the future, naming Steam as a certainty, while PS VR2 and Android XR are “maybe.” GDC’s State of the Industry report, which surveyed 3500 developers, advised 59% of VR developers are working on Quest/Horizon games, 31% for SteamVR, 16% for PS VR2, and 8% for Apple visionOS.

PlayStation VR2 also appears to be another beneficiary following decreased sales on Quest. Across the last few months, we’ve seen an increasing number of developers announce ports for Sony’s headset.

Sinn Studio co-founder Almir Brljak confirmed that Swordsman VR “sold more copies” on PS VR2 than Quest in December, calling the Sony headset’s pricing “a huge barrier.” While not a direct indicator of sales, Skydance’s Behemoth and Metro Awakening all show more user reviews on PS VR2 than Quest, though Steam shows the highest review count for Metro.

Touching upon Into The Radius’ success, Fast Travel Games CMO Andreas Juliusson recently stated that sales on PS VR2 “exceeded our expectations.” Elsewhere, Toast Interactive’s VR platformer Max Mustard sold better on Sony’s headset than Quest in the first two weeks.

Max Mustard Selling Faster On PlayStation VR2 Than Quest

Bucking the trend, Max Mustard sold more copies in its first two weeks on PlayStation VR2 than it did on Quest.

Some of this can be attributed to the specific audience. Max Mustard likely benefitted fulfilling a genre desire when Astro Bot lacked PS VR2 support, despite Rescue Mission being a PSVR hit, while Into The Radius and Swordsman would suggest PlayStation VR2 owners also prefer more “hardcore” experiences. Even then, one studio behind a more casual game revealed surprising sales.

“We have similar numbers on Meta as we do on Steam, but much higher on PlayStation. Given the size of these platforms, it’s unclear to us how this is even possible,” a studio representative said.

Considering Non-VR Platforms

Perhaps unsurprisingly, given the increasing struggle with sales on Quest and VR in general, two studios advised they’re looking more toward flatscreen gaming. Whether that’s for hybrid titles going forward or flatscreen-only wasn’t specified, though it’s clear these decisions are motivated by financial struggles.

“Compared to non-VR sales, it is increasingly feeling like we shouldn’t bother with VR or MR at all,” one studio tells me, stating sales for their game’s flatscreen edition on Steam outperforms the VR edition on Quest by 500%.

“In my opinion, the Quest Store is not on a good path. As a result, we will see a good amount of VR studios close or pivot to non-VR in the next years, leading to a big drop in quality games 2-3 years down the line,” said one developer.

A couple of developers expected layoffs and closures from many that don’t pivot to flatscreen titles. With PowerWash Simulator VR support being officially dropped, other studios evidently aren’t finding Quest profitable, though FuturLab’s port faced criticisms at launch.

Crucially, this avoided layoffs and saw the staff members redeployed to other projects. Eiche described this as a “smart business decision” because FuturLab didn’t wait until layoffs became inevitable.

PowerWash Simulator Ends VR Support As Dev Redeploys Team To Other Projects

PowerWash Simulator VR support will not continue on Quest, with FuturLab citing cost concerns and job security.

Layoffs

The last two years for many VR studios have been rough. The wider games industry remains in a rough state, tens of thousands of developers have lost their jobs and VR gaming has been hit too. WIMO Games, Archiact, First Contact Entertainment, Sony’s London Studio, and Ready At Dawn have all shut down since 2023.

Other big names hit by layoffs include nDreams, Lode, TinyBuild, Codemasters, VRChat, Soul Assembly, XR Games, Toast Interactive, Resolution Games, Firesprite, Humble Games, Supermassive Games, Downpour Interactive and, most recently, Fast Travel Games.

We’ve received emails from folks looking for contract positions as some studio heads look to “work for hire” jobs to keep their workers employed.

“I can still get by because I’m solo, but if I had employees there would be no way this would be sustainable,” one developer said.

Other Highlighted Concerns

Some developers also highlighted their worries about Meta’s recent changes to its content moderation policies across Threads, WhatsApp, Instagram, and Facebook, which includes removing fact-checking. These recent moves saw CEO Mark Zuckerberg accused of aligning himself with President Trump before his inauguration last month.

Meta faced heavy criticism both from platform users and its own staff over its updated community standards guidelines, with many worried about the rise of hate speech, homophobia, misogyny, transphobia, and more. Meta also removed transgender and non-binary themes from Messenger, killed its diversity, equity and inclusion programs, and removed accommodations for transgender staff. The current Hateful Conduct guidelines as of February 4, 2025, state the following: “We do allow allegations of mental illness or abnormality when based on gender or sexual orientation, given political and religious discourse about transgenderism and homosexuality.”

Meta Quest and Horizon Worlds use a separate Code of Conduct for Virtual Experiences. Meta defines “hate-based organizations” in another policy at the company, with a page noting “we cannot estimate prevalence for organized hate right now.”

Meta’s moderation landscape is changing rapidly, and its efforts to scale toward billions of users continues to bend heavily toward automated systems at multiple layers. Evidence recently emerged via VR enthusiast Lunayian that Meta could be dropping moderators reviewing the last few mins of audio/video after you report other users in Horizon Worlds.

One developer questioned how much longer they can ethically do business with such an organization.

We intend to explore this particular area further fully in a separate report. If you have information to share with us, or in particular a developer looking to share your thoughts on Meta’s recent moderation changes, please use our Contact Us page to get in touch or email me: [email protected].

Where does this leave the VR market?

If you’re a VR gamer, some months may seem like there are more older games getting VR mods than new VR games. Even so, there’s still a slow but steady drip of indie releases from small teams, as well as occasional tentpoles from well-funded groups with dozens of artists working on a single project.

Some developers are hopeful things will change for the better at Meta, while others cannot wait for Valve’s rumored Deckard headset. Many praised Meta for keeping the VR market as vibrant as it has been, though another conceded VR adoption has been “slower than expected.” Another criticized the infrastructure around the platform as “suffering from serious growing pains.”

- “I can’t complain too much about any company that is willing to lose this much money to inject life into a market,” states one relative newcomer to VR games development.

- “Let’s be clear—without Meta’s multibillion-dollar investment, there would likely be no VR market at the scale we see today.”

One developer believes Meta is shaping the industry in an “unsustainable” direction that’s good for retention from younger audiences – free-to-play – but bad for overall revenue. Others cited concerns about the market shifting so rapidly, while one expressed caution about chasing mixed reality experiences at the expense of VR. One studio cited shifting goalposts during development on Quest as a problem, while another believes mixed reality made some developers “forget about VR.”

Clear investments are being made into pushing Horizon Worlds and that’s particularly true on mobile, though some remain hopeful that Meta can be persuaded into course correction.

In preparation for this article, we reached out to Meta this week with a bulleted list of complaints from developers and questions we’re hoping the company can answer. We were told they’re preparing a blog post and will update with a link to that post once it is live.

As part of our reporting, UploadVR initially put a call-out for responses to a consumer survey. However, this did not receive a wide enough response to be considered viable data for the report. For transparency, we’ve included a link to the full results here.

Source link

#Metas #Shifting #Priorities #Affecting #Developers